Insurance policies are a thing that most folks have, or at the least know they must have, but normally You should not totally comprehend. Regardless of whether it’s wellbeing insurance plan, lifetime insurance plan, or auto insurance plan, these procedures Participate in a vital purpose in supplying monetary security when the surprising occurs. But what exactly are insurance insurance policies, and How come they make a difference a lot of? On this page, we'll dive deep into the whole world of insurance plan insurance policies, discover their forms, benefits, and the way to select the correct a single for yourself. Allow’s split it down, piece by piece.

At their Main, insurance guidelines are contracts that shield you against monetary decline. When you purchase an insurance plan policy, you pay a premium to an insurance company, and in return, the insurance provider claims to protect specified sorts of fees or losses Which may crop up. It’s like owning a security Web that catches you when existence throws you a curveball. The quantity you purchase this coverage is dependent upon the type of insurance plan and the level of safety you end up picking.

When you think about insurance plan policies, health insurance plan often concerns intellect initial. It’s one of the most widespread varieties, and permanently motive. Health care costs could be astronomical, and with no well being insurance policy, a single clinic take a look at may lead to some monetary disaster. Health insurance coverage insurance policies enable cover anything from regime Look at-ups to unexpected emergency surgical procedures, making certain that you simply’re not still left footing the Invoice for health-related charges that you simply can’t afford to pay for.

Insurance Company Solutions for Beginners

But health coverage is simply the suggestion of the iceberg. One more common plan is lifestyle insurance policies, which presents fiscal security for your personal family members just after your passing. It may also help deal with funeral fees, superb debts, and ongoing dwelling expenditures for your family. You can find differing types of lifetime coverage guidelines, like time period lifetime insurance policy and complete lifetime insurance policies, each offering different amounts of coverage and Rewards. Understanding these variances may help you decide which just one is the best suit for yourself.

But health coverage is simply the suggestion of the iceberg. One more common plan is lifestyle insurance policies, which presents fiscal security for your personal family members just after your passing. It may also help deal with funeral fees, superb debts, and ongoing dwelling expenditures for your family. You can find differing types of lifetime coverage guidelines, like time period lifetime insurance policy and complete lifetime insurance policies, each offering different amounts of coverage and Rewards. Understanding these variances may help you decide which just one is the best suit for yourself.Then, there’s auto insurance policy, which is typically essential by law for most locations. This coverage covers your car in the event of a collision or hurt, and it typically contains legal responsibility protection, which helps protect Other individuals involved in an accident. Whether or not you travel a brand-new car or truck or simply a very well-beloved aged a single, owning vehicle insurance is crucial. Not only will it offer reassurance, but it really also can help you save you from probably catastrophic monetary consequences in case you’re at any time in an auto crash.

Homeowners coverage is another vital plan. For those who own a home, you understand how A lot effort goes into preserving it. But Irrespective of how careful that you are, mishaps can continue to take place. Fires, all-natural disasters, theft — these are definitely all factors homeowners insurance plan can assist secure towards. This policy typically covers the framework of your own home, particular assets inside it, and occasionally even temporary living bills if your property results in being uninhabitable after a catastrophe.

But insurance policies insurance policies aren’t pretty much shielding your assets or health. You will also find policies meant to cover your online business. Small business insurance is available in lots of varieties, like general legal responsibility, residence, and personnel’ payment insurance plan. For those who’re a business operator, getting the best policies set up is very important to ensure that your company can climate fiscal storms and continue on running efficiently, regardless of the issues come up.

Among the most bewildering components of coverage policies is definitely the good print. Every single insurance policy coverage is different, with different exclusions and limits that could be not easy to decipher. By way of example, some policies may not include specific purely natural disasters like floods or earthquakes Unless of course you buy further coverage. This is where comprehending the conditions and terms is important. Often go through the plan information meticulously prior to signing everything to ensure you know precisely what’s covered and what’s not.

Yet another key idea in insurance policy procedures would be the deductible. This can be the total you fork out from pocket prior to your insurance provider commences covering your expenses. It’s similar to a threshold that must be fulfilled right before the protection Web kicks in. Some procedures have superior deductibles with low rates, while some have very low deductibles but bigger premiums. The correct harmony is dependent upon your personal money circumstance and possibility tolerance. Choosing a deductible that aligns with the finances can make a tremendous difference in how inexpensive your plan is.

Insurance policy guidelines will also be known for their rates. They are the payments you make to keep up your protection, generally on the regular, quarterly, or yearly foundation. The amount you pay is based on various elements, including the form of insurance coverage, your age, health and fitness, driving Click here for more file, plus much more. When it comes to getting the appropriate policy, evaluating premiums is See what’s new crucial, nonetheless it’s also essential to take into account the amount of coverage you’re receiving in return for that top quality. Less expensive isn’t generally far better if it leaves you subjected to considerable risks.

Speaking of challenges, it’s important to comprehend the strategy of possibility management when managing insurance policy procedures. The basic idea is insurance policy is actually a tool to handle financial hazard. By Go here spending a comparatively small high quality, you transfer the economical hazard of specific occasions to your insurer. In this way, you don’t really need to bear the total economic burden of sudden occasions, such as a significant automobile incident or a devastating home hearth. Insurance policies is actually a method to unfold out the chance, therefore you’re not remaining addressing it all on your own.

About Group Insurance Solutions

While you store all around for different insurance policies, it’s important to think about the status from the insurer. Not all insurance policy providers are created equivalent. Some are recognized for excellent customer care, rapid promises processing, and good settlements, while others might leave you discouraged when it’s time for making a declare. Do your investigate, go through critiques, and Be certain that the insurance company you decide on contains a reliable reputation of supporting policyholders in situations of will need.What Does Insurance Coverage Plans Mean?

Certainly one of A very powerful items to consider when buying insurance plan is the amount of coverage you truly need to have. It’s simple to are convinced extra protection is usually improved, but In fact, you don’t need to in excess of-insure you. For example, shopping for life insurance policy which has a payout that’s far more than what Your loved ones demands can be an unneeded drain on your finances. On the flip side, under-insuring you could depart you in a troublesome location if anything occurs and you don’t have more than enough protection to handle the results.

Eventually, existence modifications, and so do your insurance plan requires. As you get older, begin a family, or accumulate assets, you may have to adjust your insurance guidelines to better match your new situations. This is where periodic opinions come in. Consistently assessing your insurance policy requires will help ensure that your procedures are still aligned using your present-day problem and that you choose to’re not paying for coverage you now not need or leaving gaps in protection which could harm you down the line.

For many who may well discover insurance policy insurance policies too much to handle, working with an agent might be a large assistance. Insurance coverage agents are specialists who can manual you through the process of choosing the proper guidelines dependant on your preferences and finances. They will make clear the nuances of differing kinds of coverage, allow you to come across special discounts, and make sure you’re getting the finest price for your cash. Don’t wait to achieve out to a professional if you’re Doubtful about what’s ideal for you.

The world of insurance policies procedures can in some cases feel just like a maze, however it’s one which’s value navigating. When it may well acquire just a little energy upfront to be familiar with the ins and outs of coverage, the safety and assurance it offers make it a worthwhile investment. Whether you’re defending your wellness, your home, or your enterprise, the proper insurance plan policy could make all the primary difference when existence throws you a curveball.

In conclusion, insurance coverage policies are necessary instruments that enable safeguard you from monetary hardship in the event the surprising occurs. From wellness to home to vehicle and further than, there are insurance policies for almost every single problem. It’s significant to grasp your preferences, shop all over for the most beneficial coverage, and evaluate your guidelines routinely to make certain that you’re often adequately protected. The reassurance that includes possessing the correct coverage protection is priceless, and it’s some thing everyone should prioritize.

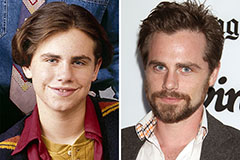

Rider Strong Then & Now!

Rider Strong Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!